PAN - Aadhaar Linking

The Government of India has made it mandatory to link Aadhaar with PAN; failing to do so will result in your income tax return not being processed. Additionally, individuals conducting bank transactions exceeding ₹50,000 must ensure their Aadhaar is linked with their PAN card. The process of linking PAN with Aadhaar is simple and can be completed through multiple methods. The government had set a deadline of September 30, 2019, for this linkage.

In this article, we have discussed the steps to link Aadhaar with PAN, its consequences, and other essential details related to this mandatory process.

PAN-Aadhaar Linking Process

Linking your PAN card with your Aadhaar card is simple, and you can do it in two ways:

1. Through SMS : Send a message in the required format.

2. Through the PAN portal: Use the official online service.

For your convenience, both methods are outlined below for complete understanding.

Also Read: How to Update Mobile Number in voter id?

Through SMS

You can link your Aadhaar with your PAN by following these simple steps:

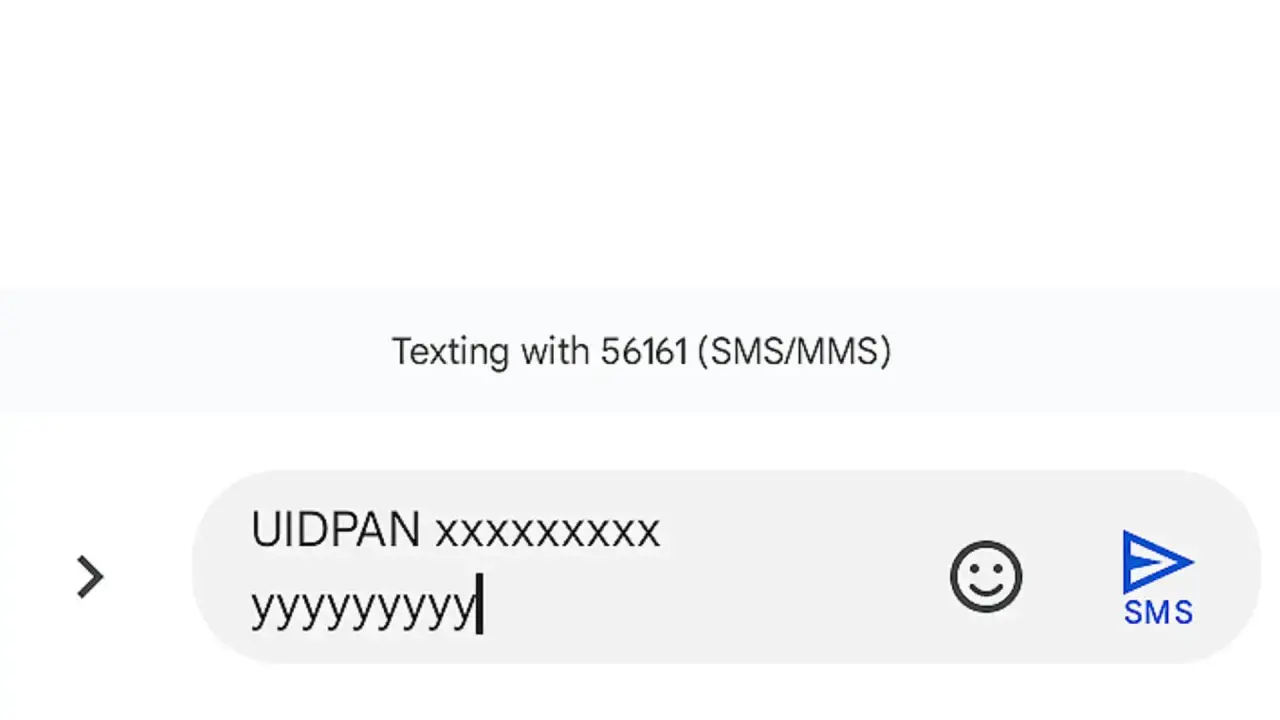

Step 1. open your phone’s messaging app and type the message in the correct format: UIDPAN (space) Aadhaar Number (space) PAN Number

Step 2. send the SMS from your registered mobile number to 56161 or 567678.

After processing, you will receive a confirmation message regarding the status of your Aadhaar-PAN linking.

Example

If your Aadhaar number is xxxxxxxxxx and your PAN is yyyyyyyyy

UIDPAN <space>xxxxxxxxxx<space> yyyyyyyyyy

Send it to 56161 or 567678.

Online Process

Individuals can easily link their Aadhaar with their PAN by following these steps:

Step 1: Visit the Income Tax e-filing portal.

Step2. The official portal will displayed

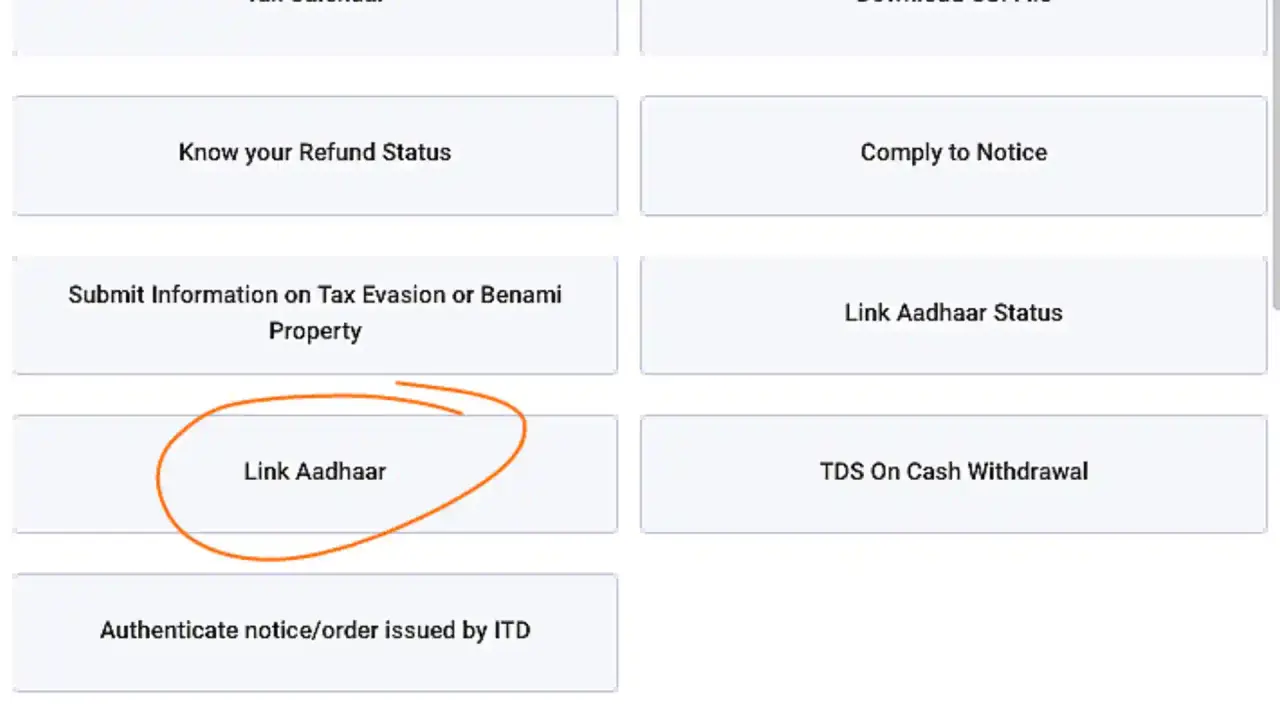

Step 3. Navigate & scroll Quick Links section

Step 4. Click on "Link Aadhaar"

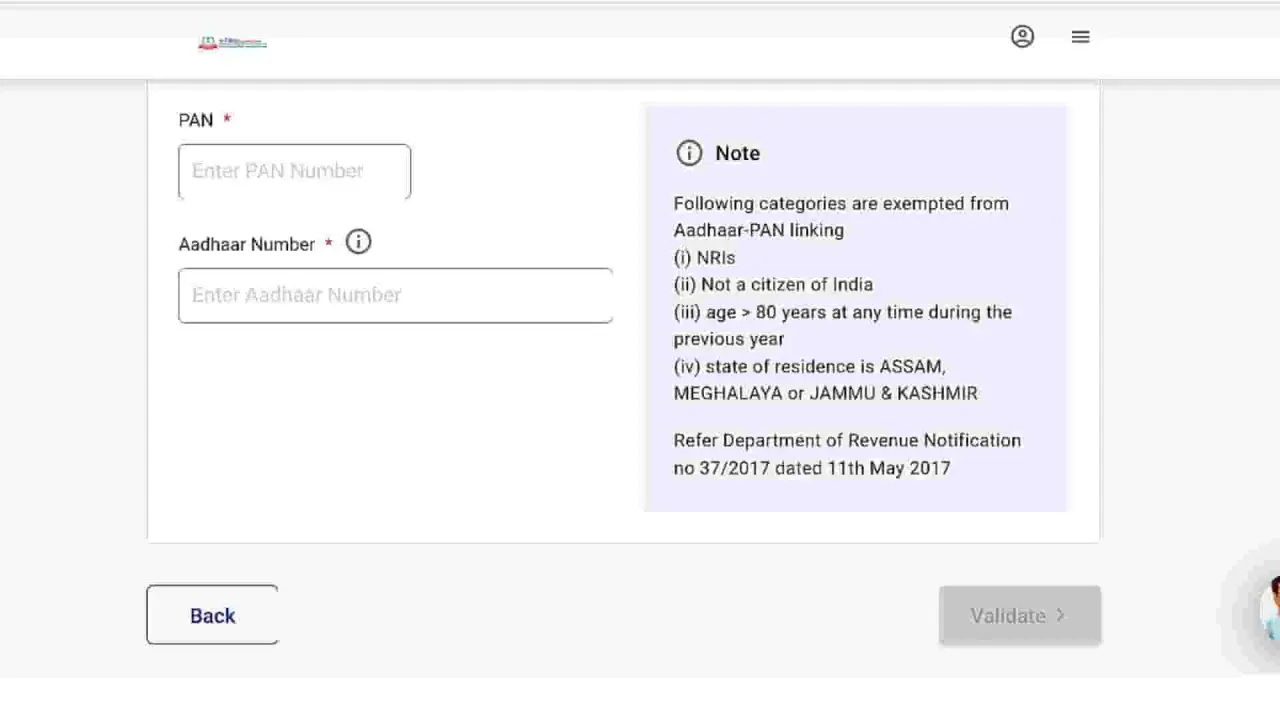

Step 5. Enter your PAN, Aadhaar number, and name as per Aadhaar.

Step 6. If only the birth year is mentioned on Aadhaar, check the box.

Step 7: Enter the captcha for verification.(If Applicable)

Step 8: Click ‘Link Aadhaar’ to submit.

Step 9: A confirmation message will appear upon successful linking.

Note: Visually impaired users can request an OTP instead of entering the captcha.

For your convenience, the direct link forrr Aadhaar-PAN linking is provided in the Important Weblinks section.

Consequences of Not Linking

Linking your PAN card with Aadhaar is now mandatory. Without this linkage, your income tax return will not be processed. Additionally, if you conduct banking transactions of ₹50,000 or more, linking Aadhaar with PAN is essential.

As per the Income Tax Department, failing to link PAN with Aadhaar will render your PAN invalid under Section 139AA of the Income Tax Act. Once deactivated, you will be unable to file your ITR online, and any pending tax refunds may be affected. Furthermore, an inactive PAN cannot be used for financial transactions.

According to the latest directive from the Government of India, if you do not complete the PAN-Aadhaar linking, your PAN will be marked as ‘inoperative’ after June 30, 2023.

Related Articles

Important Weblinks

| Pan-Aadhaar Link | Click Here |

| Check Pan-Aadhaar Link Status | Click Here |

| Official Website | Click Here |

| Find More | Click Here |

| Follow Us | Click Here |

Also Read: How to Download E-Voter Id?

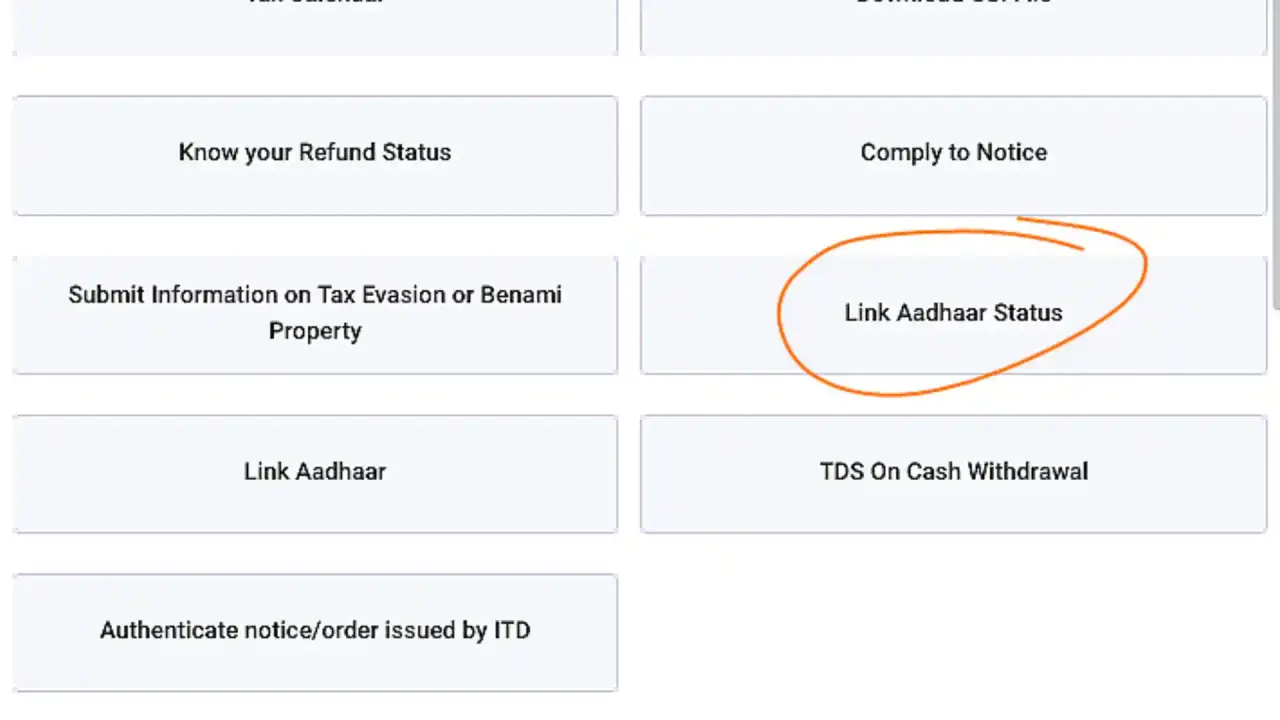

How to Check Pan-Aadhaar Link Status

To verify whether your Aadhaar is linked to your PAN, follow these simple steps:

Step 1: Visit the official Income Tax e-filing portal.

Step 2: Go to the Quick Links section.

Step 3: Click on "Link Aadhaar Status" under the Quick Links section.

Step 4: Enter your Aadhaar number and PAN number, then click on "View Aadhaar Link Status."

Step 5: Your linking status will be displayed. If your Aadhaar is successfully linked to your PAN, a message will appear:

For your convenience, the direct link to check Aadhaar-PAN linking status is provided in the Important Weblinks section.